A good credit score is more than just a number; it’s a key indicator of your financial health and stability. In today’s high-interest market, having a good credit score opens doors to various opportunities and can save you significant amounts of money over time. Understanding why a good credit score is important and how to improve it is essential for anyone looking to secure their financial future.

Firstly, having a good credit score means you are more likely to be approved for loans and credit cards. Lenders use your credit score to assess your creditworthiness, and a higher score signals that you are a reliable borrower. This not only increases your chances of loan approval but also often results in lower interest rates. Over the life of a loan, lower interest rates can save you thousands of dollars, making large purchases like a home or car more affordable.

Figure 1: Buying a Tesla Model 3 with Low and High Credit Scores.

Let’s take a look at an example. Cindy and John both purchase a Tesla Model 3 (Figure 1). Cindy has a credit score of 750, whereas John’s score is only 550. Consequently, Cindy receives a lower APR compared to John, resulting in her monthly payment being approximately $112 less. Over the term of the loan, Cindy ends up paying nearly $6,500 less for the Tesla Model 3.

Additionally, a good credit score can lead to higher credit limits. Lenders are more willing to extend larger amounts of credit to individuals who have demonstrated responsible credit behavior. This can provide you with greater financial flexibility and the ability to manage your finances more effectively.

Your credit score also plays a role in other areas of your life. For example, many insurance companies use credit scores to determine premiums. A higher credit score can lead to lower insurance costs, which can add up to significant savings over time. Moreover, some employers check credit scores during the hiring process, especially for positions that require financial responsibility. A good credit score can enhance your job prospects and open up more career opportunities.

When it comes to renting a home, landlords often use credit scores to evaluate rental applications. A higher score can make it easier to secure a desirable rental property, giving you more options when looking for a place to live.

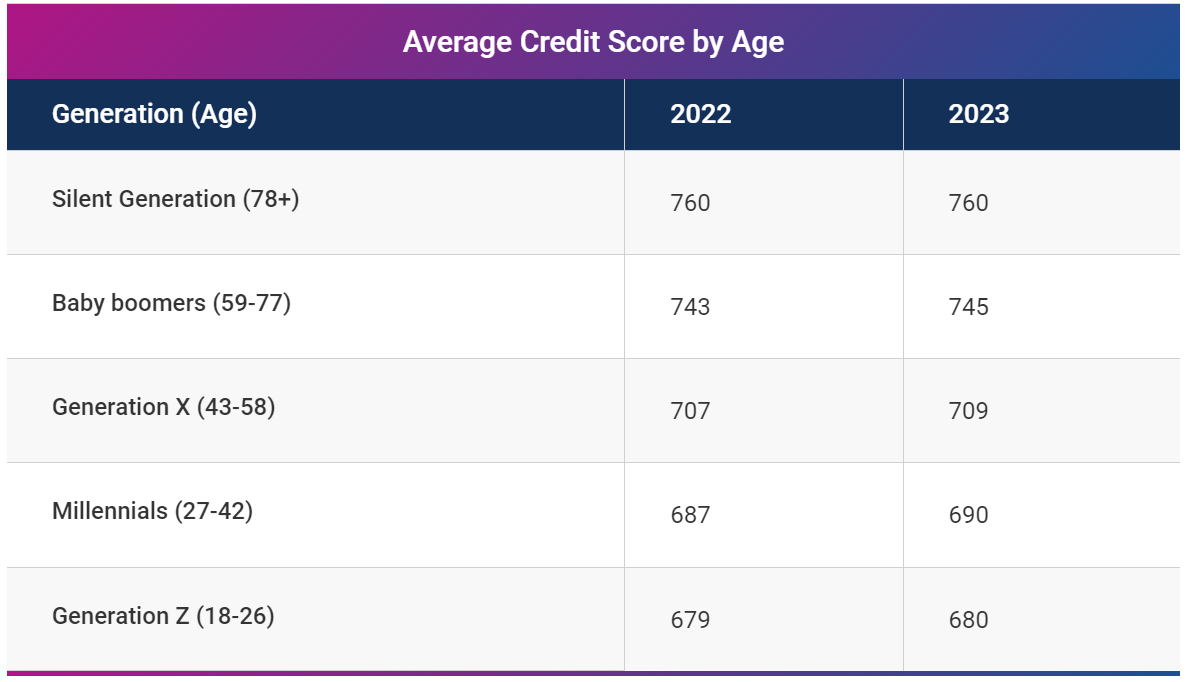

As of April 2024, the average American credit score was 717, according to a blog post from FICO. This is considered a “very good” score on the VantageScore model, which ranks scores from 300 to 850. However, average credit scores can vary by age and location. For example, as of the second quarter of 2023, Experian reported the following average credit scores by generation:

Source: Experian, 2023

Maintaining a good credit score is not always easy. Negative remarks on your credit report, such as late payments, defaults, or collections, can significantly damage your score. These blemishes can stay on your report for years, making it difficult to obtain credit, secure favorable interest rates, and achieve your financial goals. According to a recent study conducted by the Federal Trade Commission, as many as 42 million Americans have mistakes on their credit reports — that’s about 13% of the entire national population. These errors can unjustly lower your credit score, highlighting the importance of regularly reviewing your credit report and addressing any inaccuracies promptly.

Through our interactions with customers, we have found that many negative marks result from moving to a new property or location. Often, old leasing companies fail to update information, leading to utility companies continuing to charge for services at the old address without receiving payment. Consequently, these unpaid bills can drag down credit scores.

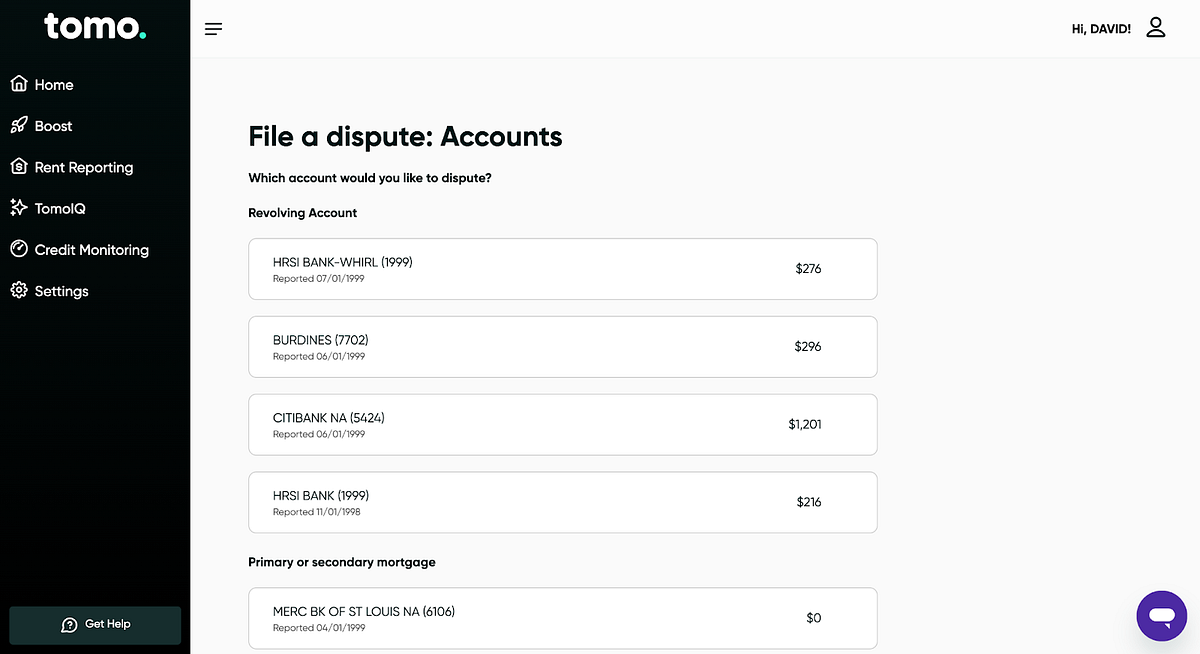

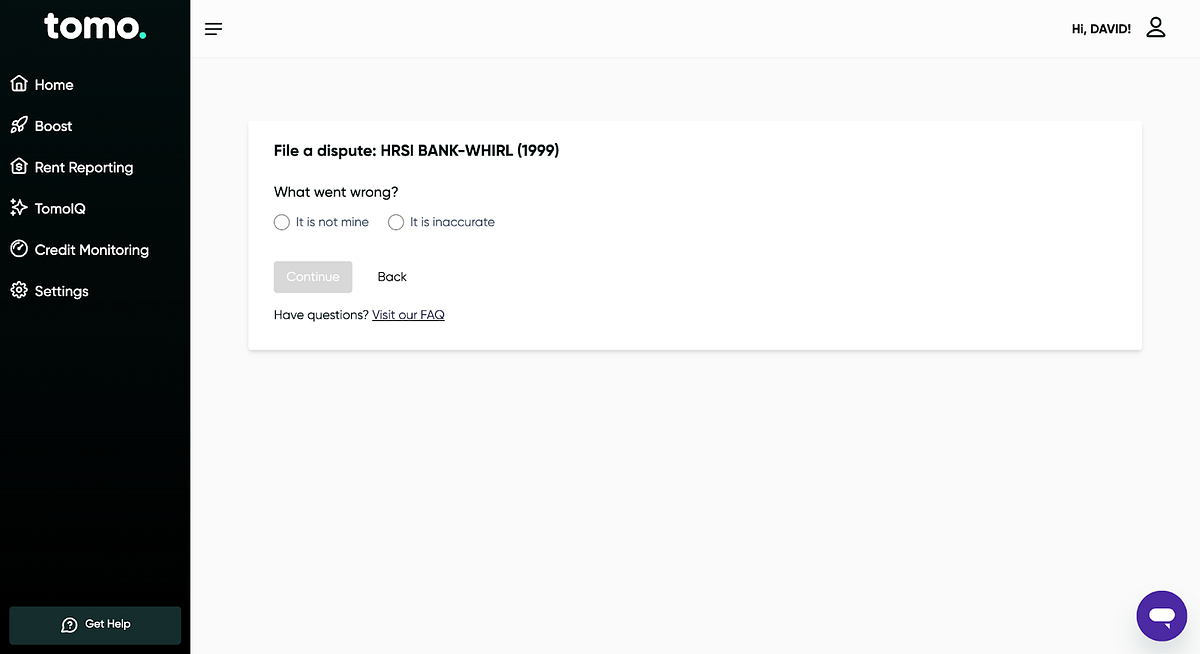

If you find yourself in a situation where your credit score is less than ideal, TomoCredit’s Credit Dispute Service can be an invaluable resource. TomoCredit offers a comprehensive credit report analysis to identify inaccuracies or errors that may be negatively impacting your score. Their team of experts works on your behalf to dispute incorrect or unfair negative remarks with credit bureaus and creditors. This process involves gathering evidence, drafting dispute letters, and following up to ensure errors are corrected.

In addition to dispute resolution, TomoCredit provides a personalized credit repair plan based on your unique situation. This plan may include strategies for paying down debt, establishing a positive payment history, and utilizing credit responsibly. TomoCredit also equips you with educational resources to help you maintain a good credit score in the long term. This includes tips on managing your finances, understanding credit scoring models, and avoiding common pitfalls.

Credit repair is not a one-time event but an ongoing process. TomoCredit offers continued support and monitoring to help you stay on track and make adjustments as needed. By leveraging their expertise and resources, you can work towards a better credit score and a more secure financial future.

Investing in your credit health today can lead to a brighter and more prosperous tomorrow. A good credit score opens doors to numerous financial opportunities and can significantly enhance your quality of life. If your credit score is suffering due to negative remarks or inaccuracies on your credit report, TomoCredit’s Credit Dispute Service is here to help.

Don’t let past mistakes or errors hold you back — take control of your credit with TomoCredit. Our team is experienced in handling credit disputes and are ready to help you build a strong credit score and save you money.