The holiday season is a time of celebration, connection, and giving. However, it’s also a time when many people find themselves overspending and feeling the financial strain that often follows in January. With so many expenses tied to gifts, travel, food, and parties, it’s easy to lose track of your budget. But the good news is, you don’t have to sacrifice the joy of the holidays to keep your finances in check. By making thoughtful decisions and planning ahead, you can enjoy the season while staying within a budget.

One of the first steps to managing holiday spending is to set a realistic budget. The key is to know what you can afford and then stick to that limit, no matter what. Start by outlining all your expected holiday expenses, including gifts, decorations, travel, food, and even small items like holiday cards. Once you have a clear picture of what the season will cost, break that down into manageable amounts. This way, you’re not caught off guard by hidden or unexpected expenses.

A critical part of keeping holiday spending in check is being mindful about gift-giving. Many people feel pressured to buy presents for everyone, from close family members to distant acquaintances. But this can quickly become expensive. Instead, make a list of the people who matter most, and prioritize your spending on them. It’s also worth considering alternatives to traditional gift-giving. Personalized or handmade gifts can carry much more sentimental value and often cost significantly less. For example, a thoughtful photo album or a batch of homemade cookies can mean more to loved ones than an expensive item from the store.

While it’s tempting to splurge on holiday sales, it’s important to remember that not every sale is a good deal. Black Friday and Cyber Monday offer plenty of discounts, but it’s easy to get caught up in the excitement and overspend. To avoid this, focus on buying only the items you planned for and avoid impulse purchases. If you’re a credit card user, now is the time to make the most of rewards and cashback offers. This can give you a bit of relief, knowing that you’re getting something back on your spending.

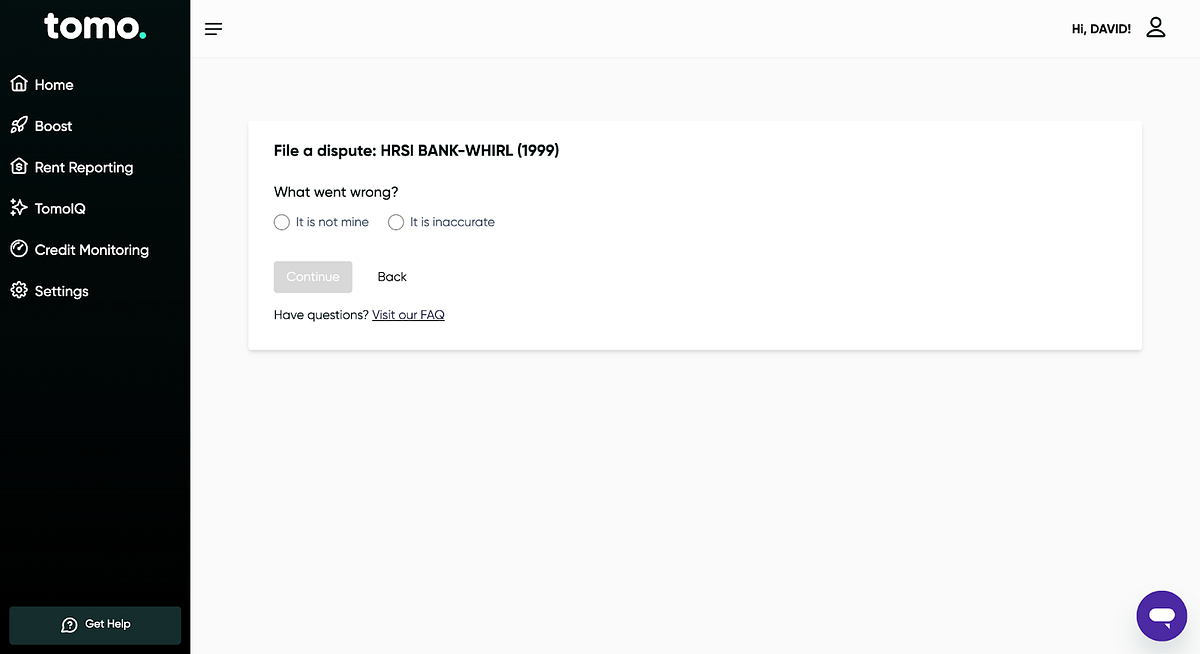

One of the biggest pitfalls during the holiday season is relying too heavily on credit cards without a plan to pay off the balance. While credit can be helpful, carrying high balances into the new year can lead to long-term debt due to interest charges. A good rule of thumb is to only charge what you can afford to pay off within a month. If you do need to make larger purchases, consider using tools like TomoBoost, which helps you manage and improve your credit score, giving you better access to lower interest rates in the future.

Another way to keep your spending in check is to look for free or low-cost holiday activities. It’s easy to get swept up in the idea that the holidays require elaborate celebrations and expensive events. However, many communities offer free festive experiences, like light displays, holiday markets, or parades. Potlucks or cookie exchanges with friends and family are also great ways to celebrate without the financial burden of hosting an entire meal yourself. These activities still allow you to enjoy the season without the stress of overspending.

As you navigate your holiday spending, it’s important to remember that the financial decisions you make now can impact you well into the new year. Planning ahead for next year’s holiday expenses can save you from scrambling when the season arrives again. Consider setting up a separate savings fund specifically for holiday spending, so you’re better prepared when it’s time to shop, travel, and celebrate. Contributing a small amount each month can add up, giving you a financial cushion for next year’s festivities.

In the end, the holidays are about spending time with loved ones and creating meaningful memories. While it’s easy to get caught up in the pressure to buy and spend, remember that thoughtful planning and smart financial choices can make the season just as enjoyable, without the stress of financial regret. And as you work to balance your budget, consider how credit tools like TomoBoost can help you stay on track and improve your financial health year-round.

By making mindful choices and staying true to your budget, you can fully enjoy the warmth and joy of the holiday season without the worry of starting the new year with debt. The holiday magic doesn’t have to come with a hefty price tag—it’s all about celebrating within your means and appreciating the moments that matter most.