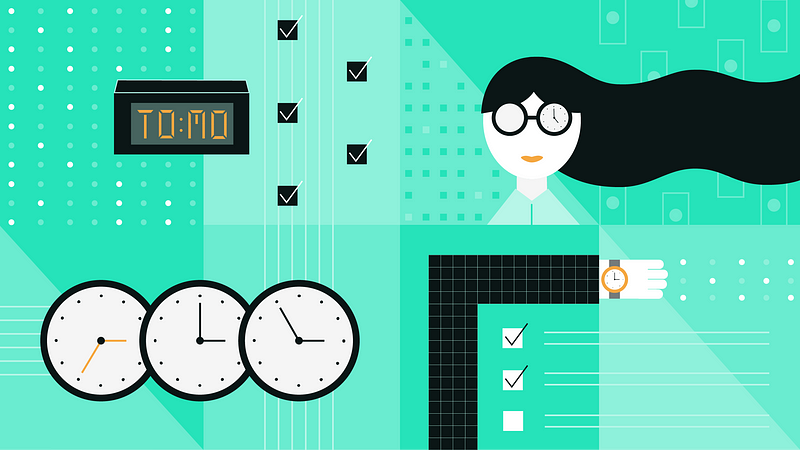

Time management is something we could all get better at, let’s be honest. Whether it be on the job, in school, or even in your personal life, effective time management has significant benefits. Time management helps you accomplish more tasks quickly and leaves you stress free. There are many different ways to go about managing your time and tools to help you get started, making this much easier. The downside of this is that it can sometimes feel like there are too many different apps out there. Luckily, there are only a few you actually need to tackle time management head on.

Download a Calendar App

One of the most important tools, if not the most important, you can use is a calendar app. A good calendar app will allow you to use it with several devices including your mobile phone and computer. This way, you will always have your calendar right at your fingertips and be able to quickly add something without giving it a second thought or wasting a second of your time. An app likse Google Calendar can not only sync any changes made from multiple devices, but can remind you of upcoming events, allow you to share events with friends, or create a Google Meet call with the touch of a button. These help you to do more and be more connected, especially via Google Meet (a major selling point when working from home or socially distancing).

Make a To-Do List

Another classic time management tool is a to-do list. Although pretty old-fashioned, this tried and true method holds you accountable for all you need to accomplish on any given day. The key to success is not falling behind and setting realistic goals. No, you probably can’t get everything you need to get done before November in the next 3 days, but you can certainly get everything you need done today ahead of time and set yourself up for success. If you end up falling short of your goal, don’t give up. Instead, restructure your list so it’s a bit more realistic and try again tomorrow. By keeping your daily to-do lists short enough to be achievable, you will not only be on track to complete everything you need to get done ahead of time, but you might even end up having fun doing it and want to knock some things off tomorrow’s list as well. Don’t believe it? Try it yourself!

Clean Out Your Inbox

Lastly, take the time to clean out your email inbox. It’s not fun, but by unsubscribing to all the emails you no longer wish to receive and deleting old ones, you’ll find yourself spending much less time sifting through your entire inbox of 11,479 unread emails. As an added bonus, you won’t miss any important events or news you might need to attend to.

Benefits

These methods can help you get more tasks accomplished faster. As if that wasn’t good enough, you’ll soon find yourself having more free time on your hands after getting things done ahead of time. Say goodbye to the stress of having too many things to do and not enough time. You’ll no longer need to bear the weight of knowing you should have done more today or that you’ll have to pick up the slack tomorrow.

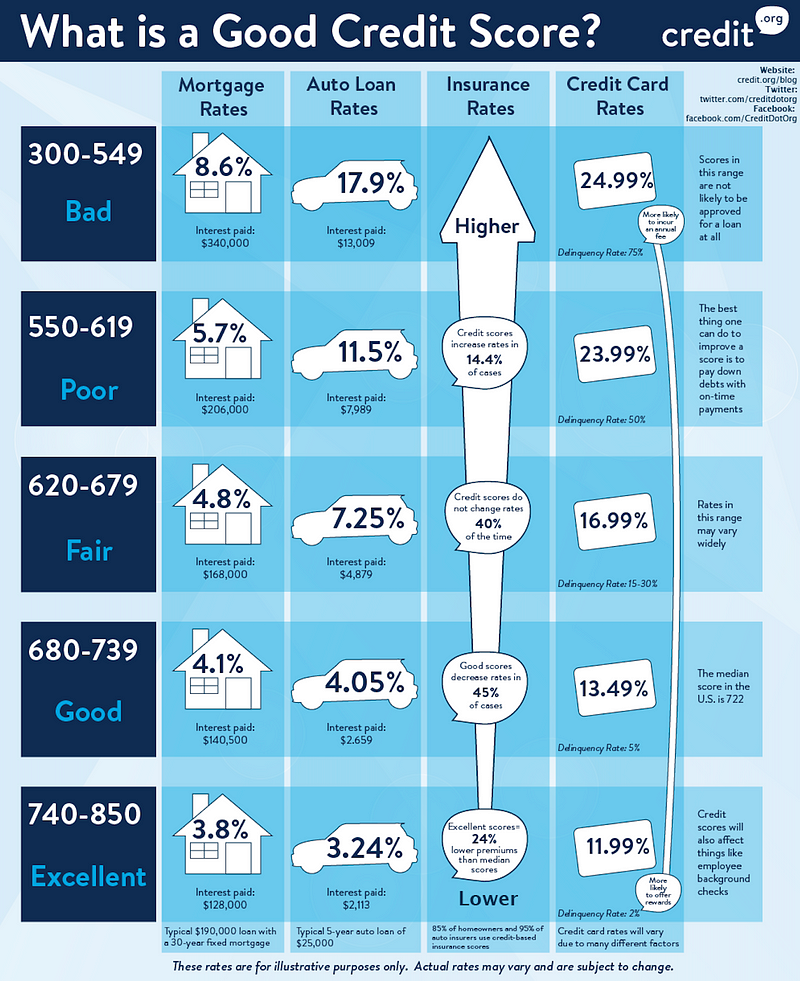

The benefits of good time management are linked to financial health — often overlooked but necessary to achieving the things you want faster. Both time and money are necessary commodities that will enhance your life when managed mindfully. With good financial health, you will be better positioned to achieve more of what you want in life.. For example, you’ll be eligible for better mortgages, auto loans, and many other things! These will all save you a ton of money over the course of your lifetime. By continually saving, you’ll save yourself the worry of being unable to tap into your emergency fund should a major crisis come your way.