With the potential for an interest rate drop, many consumers may wonder how it could impact their financial situation. A decrease in interest rates can present several valuable opportunities, especially for those looking to borrow or refinance existing debt.

One of the most significant benefits of a rate drop is the potential for lower mortgage rates. If you’re considering purchasing a home or refinancing your current mortgage, a reduction in interest rates could lead to substantial savings. Even a small decrease can lower your monthly payments and reduce the total interest you’ll pay over the life of the loan. For homeowners, refinancing during a period of falling rates can provide an opportunity to either lower monthly payments or shorten the loan term, both of which can lead to long-term financial gains.

Similarly, lower interest rates can make personal loans and credit cards more affordable. For borrowers with strong credit, a drop in rates can lead to lower annual percentage rates (APRs) on new loans, making debt consolidation or large purchases more manageable. Even individuals with bad or average credit may find it easier to qualify for a loan with reasonable terms when rates are low. This can be especially helpful when consolidating high-interest debt, as lower rates will allow you to pay down your balances faster and save money on interest. TomoCredit offers a great way to build or repair your credit, giving you more options for borrowing when interest rates are in your favor.

For business owners, lower interest rates present opportunities to access affordable financing. Whether you’re looking to expand, invest in new equipment, or manage cash flow, lower rates make borrowing more attractive and cost-effective. Reduced loan payments can free up capital for reinvestment in your business, helping to support growth and efficiency. For startups or small businesses, lower interest rates can also make it easier to qualify for loans that were previously out of reach, providing much-needed funds for expansion or operational improvements.

If you’re planning to purchase a new vehicle, a rate drop could make your auto loan more affordable as well. Lower interest rates translate into lower monthly payments and reduced interest over the life of the loan, allowing you to save money. For those already financing a car, this could also be a great time to consider refinancing your auto loan to take advantage of the lower rates.

A drop in interest rates can also boost consumer spending power. When borrowing becomes cheaper, people are more inclined to make large purchases, like homes, cars, or home renovations. This increase in spending can stimulate the economy, benefiting various industries. For consumers, this is an ideal time to consider significant financial moves, as lower interest rates can help you stretch your budget further and make smarter investments.

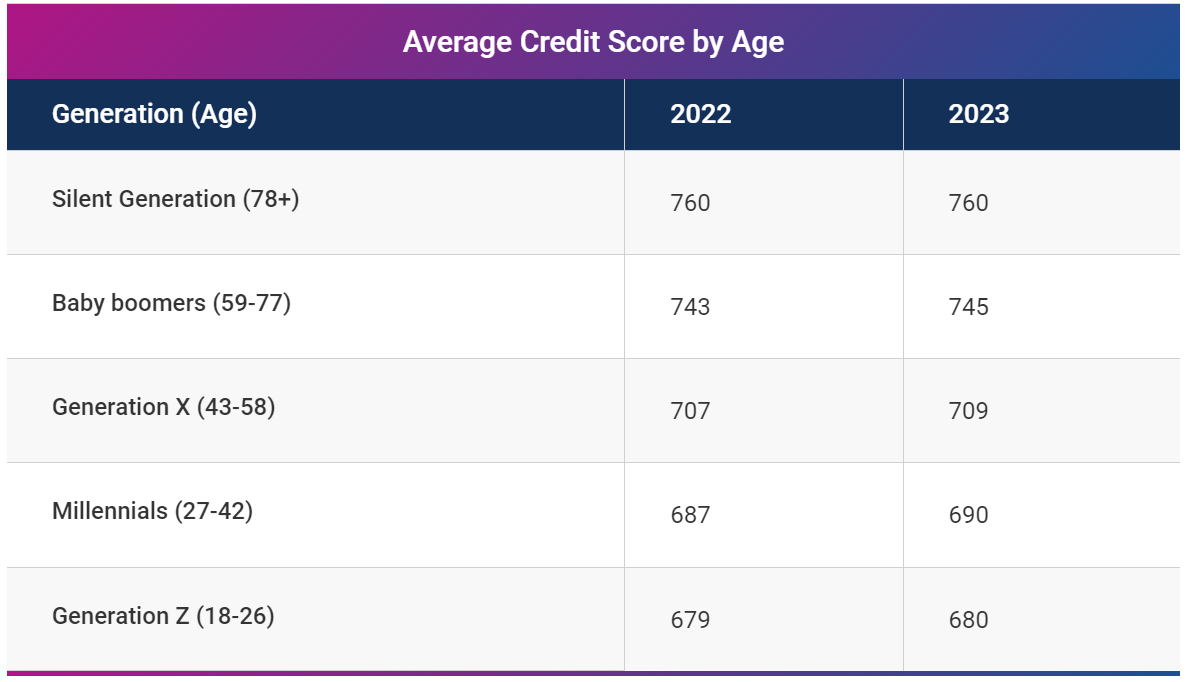

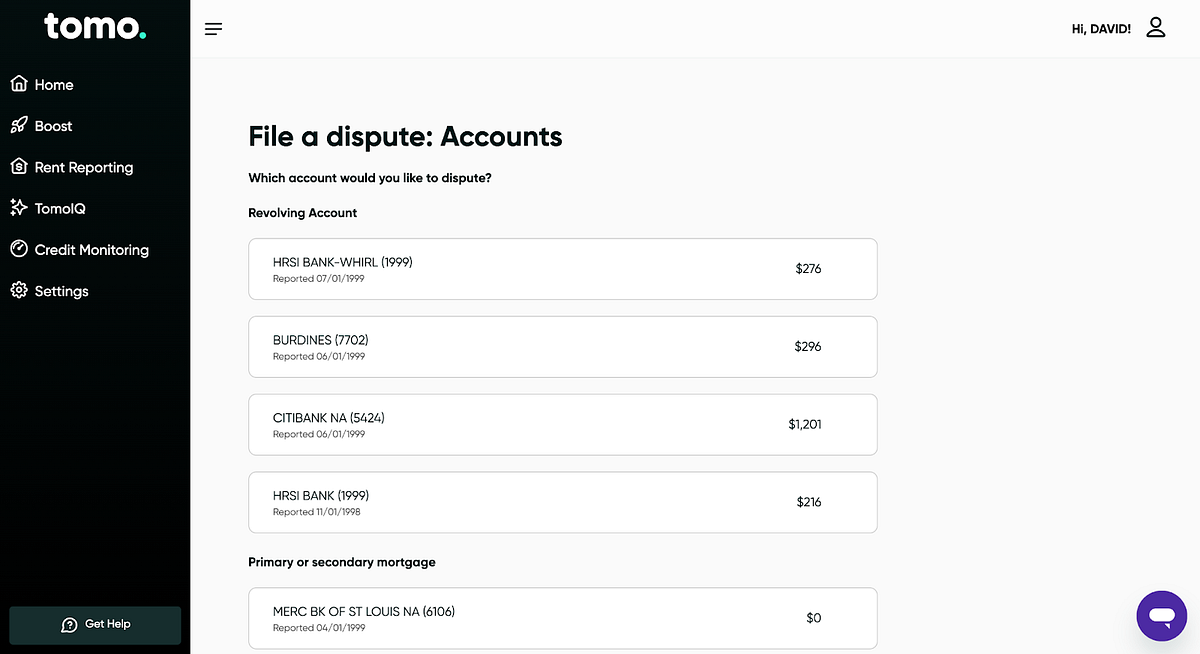

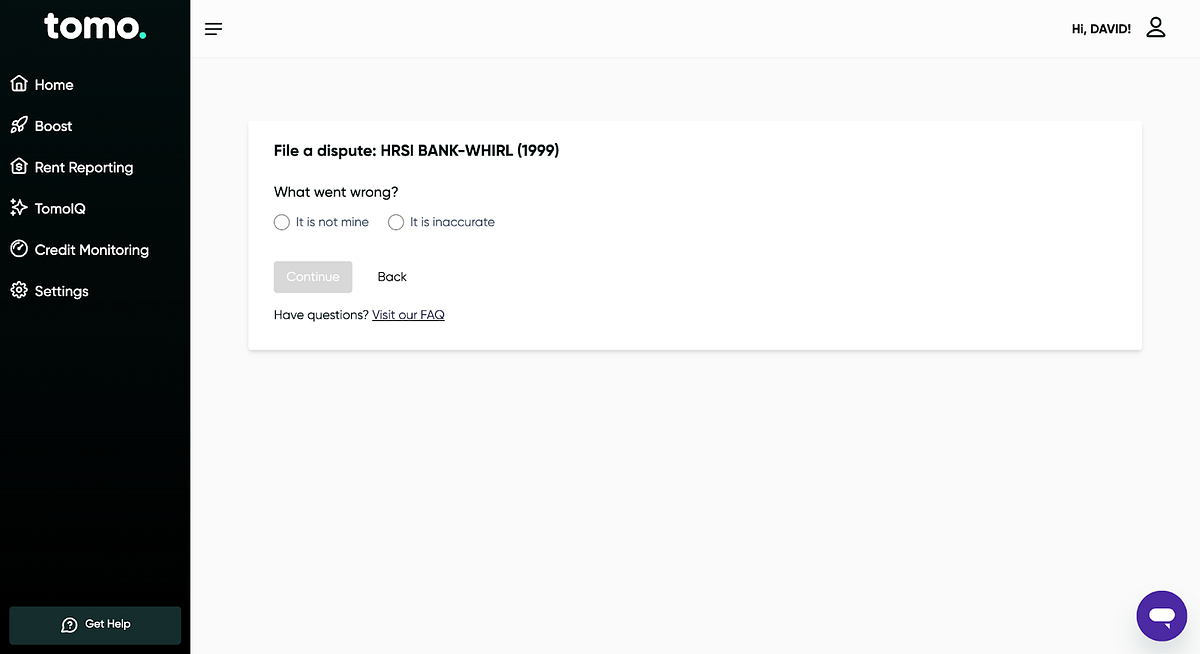

For individuals working to build or rebuild their credit, falling interest rates offer additional advantages. With lower rates on credit cards and loans, it becomes easier to manage debt responsibly and avoid missing payments. Staying current on payments can reduce your credit utilization and improve your credit score over time, positioning you for better terms on future loans. If you’re looking to strengthen your credit profile, TomoCredit provides tools and resources to help you build or repair your credit, making it easier to take advantage of these financial opportunities.

An interest rate drop offers several financial perks that can help you save money and make more informed financial decisions. Whether you’re looking to buy a home, refinance existing debt, or improve your credit, lower rates provide valuable opportunities to enhance your financial well-being. Keep an eye on the market and take advantage of these opportunities when they arise—you could set yourself up for long-term financial success.

At TomoCredit, we’re here to support you on your financial journey. Whether you need advice on credit-building strategies or want to explore ways to make the most of changing interest rates, our team is ready to help. Feel free to reach out, and let us guide you toward a brighter financial future.