Crypto has been viewed upon as speculative instruments, not payment mechanisms. While Bitcoin was originally intended to be a new world currency, it has transitioned to more as a hedge against inflation and a store of value. In a sense, spending Bitcoin would be a lot like spending Apple stock. Sure, you can spend it, but it would also be fairly regretful if the remainder of your holdings kept going up. The psychology behind this prevents users from making this a true payments system (unless you had a ton to get rid of).

However, with the advent of Stablecoins, the game has changed. Stablecoins are cryptocurrencies that maintain a $1 peg, which means that they are not meant to be speculative assets. Newer networks allow pretty amazing interest rates on top of these, but in general, these should not be any different than the $1 in your bank account, your credit balance, or in your wallet.

Stablecoins come in many forms, asset backed (like USDC), algorithmic (like UST), or a combination of both. In general, there are some controversies on how a stablecoin can maintain a peg even during volatile market conditions. But why is this so hard to spend today?

Take an example of how you’d have to do it:

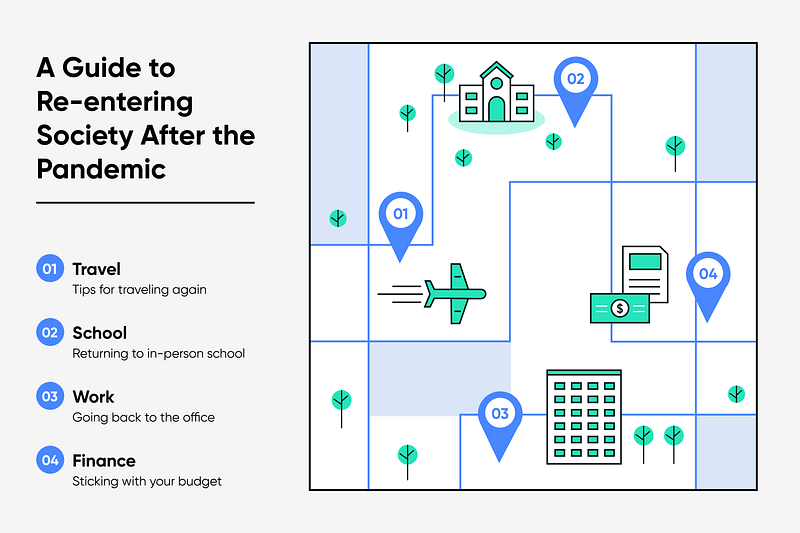

01

Send to a crypto exchange

To spend your crypto, you must first take it off any wallet or protocol you have it in, that means sending it to an exchange.

02

Trade to USD

That’s right, just like any other crypto asset, you need to convert crypto on an exchange. Some offer free conversions from USDC, but otherwise you have to pay fees too.

03

Send to a Bank account

Even with the benefits of crypto instant settlement, you still need to withdraw to your bank account after you sell on an exchange, which can take an extra day or two.

How TomoCredit is Solving the Payments issue

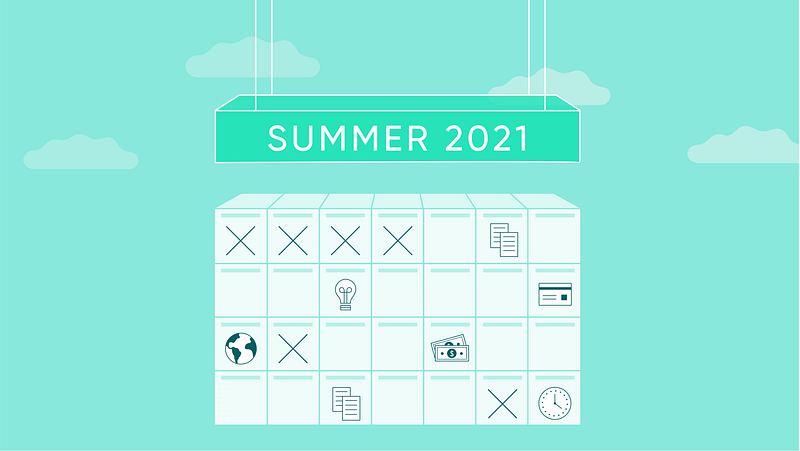

Tomo is a crypto wallet

We think making the core product a crypto wallet is important, that way you can have the safety of a custodial wallet.

Choose which coins to spend

We default to your stablecoins, but if you prefer to spend other crypto assets, you can choose them as a default.

Autopay automatically converts and pays off your card

No need to worry about trading or withdrawing, Tomo will automatically convert coins that are needed to pay off your credit balance. Spend your credit card like you normally would.