At TomoCredit, we understand the unique challenges young and mid-age professionals face in today’s dynamic job market. As you navigate career transitions, explore new opportunities, and consider purchasing property, understanding the financial landscape is crucial. Here’s a closer look at the recent trends in mortgage rates, their implications for homebuyers, and strategies for managing your 401(k) when changing jobs.

Mortgage Rates and the Housing Market: A Recap of June

In June, we saw a slight decline in mortgage rates, a trend expected to continue into July as inflation cools. This decrease isn’t steep but gradual, like a marble slowly rolling across the uneven floor of a 150-year-old house.

Mortgage rates peaked in May, with the 30-year fixed-rate mortgage averaging 7.22%. By the end of June, this rate had fallen to 6.86%, thanks to a reduction in the core consumer price index from 3.8% in March to 3.4% in May. Typically, when inflation falls, mortgage rates follow suit, and this trend seems likely to persist if inflation continues to decrease.

However, even with a slight drop in mortgage rates, affordability remains a concern. The median home resale price hit an all-time high of $419,300 in May. With an average mortgage rate of 7%, the principal-and-interest payment on a median-priced home, assuming a 20% down payment, was $2,232. High costs led to a 2.8% drop in home sales compared to the previous year.

As buying slowed, the inventory of existing homes for sale increased. This rise in inventory, coupled with weaker demand, has driven price reductions, with 36.9% of homes on the market cutting their asking prices as of late June. If mortgage rates decrease this autumn as expected, the combination of lower home prices and interest rates could improve affordability.

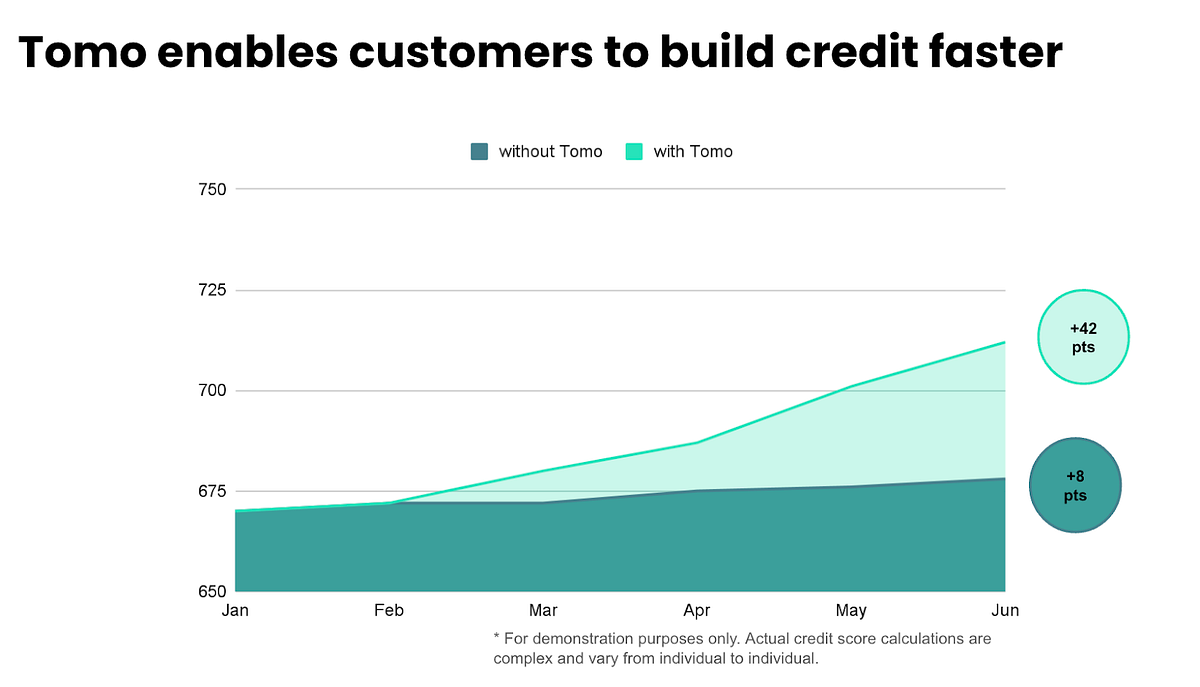

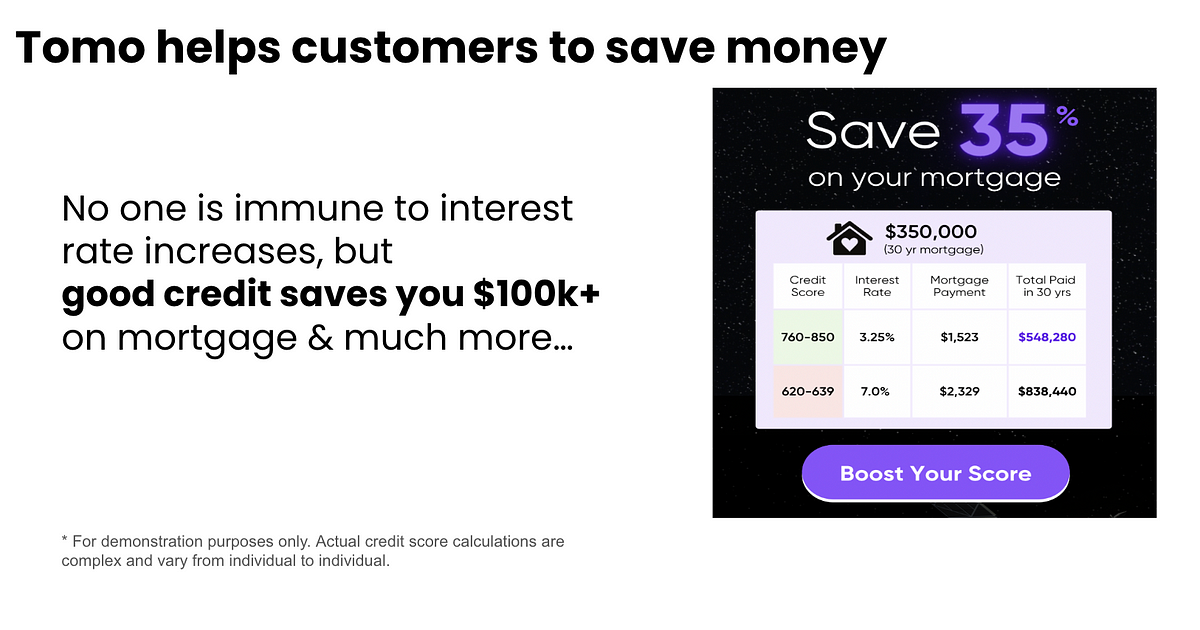

For those with excellent credit scores, there’s an added advantage. A higher credit score often translates to better interest rates, potentially lowering your monthly mortgage payments and making homeownership more attainable.

Career Transitions and 401(k) Strategies

For young professionals, job transitions are often accompanied by questions about managing retirement savings. Here are some strategies to consider when handling your 401(k) during a job switch:

- Stay Committed to Your Long-Term Goals: Market volatility can be unsettling, but maintaining your long-term investment strategy is crucial. Regular contributions to your 401(k) can help you take advantage of dollar-cost averaging, smoothing out the purchase prices of investments over time.

- Review and Adjust Your Portfolio: Ensure your asset allocation matches your retirement goals and risk tolerance. Diversification can help mitigate risks and protect your investments from market fluctuations.

- Maximize Your Contributions: If possible, contribute the maximum allowable amount to your 401(k). This strategy not only boosts your retirement savings but also provides significant tax advantages.

- Take Advantage of Employer Matching: Ensure you contribute enough to receive the full employer match in your new job, as it’s essentially free money for your retirement.

- Consider a Roth 401(k): If your new employer offers a Roth 401(k) option, it might be worth considering. Roth 401(k)s allow for tax-free withdrawals in retirement, which can be advantageous if you expect to be in a higher tax bracket when you retire.

- Rollover Your 401(k): When you leave a job, you can roll over your 401(k) into an IRA or your new employer’s 401(k) plan. This keeps your retirement savings intact and can provide more investment options.

As you navigate career changes and consider homeownership in a high-interest-rate environment, staying informed and proactive is key to making sound financial decisions. At TomoCredit, we are dedicated to empowering young professionals with the knowledge and tools needed to achieve their financial goals. Whether you’re transitioning to a new job or exploring the housing market, understanding the current economic trends and managing your retirement savings effectively will help you secure a brighter financial future.